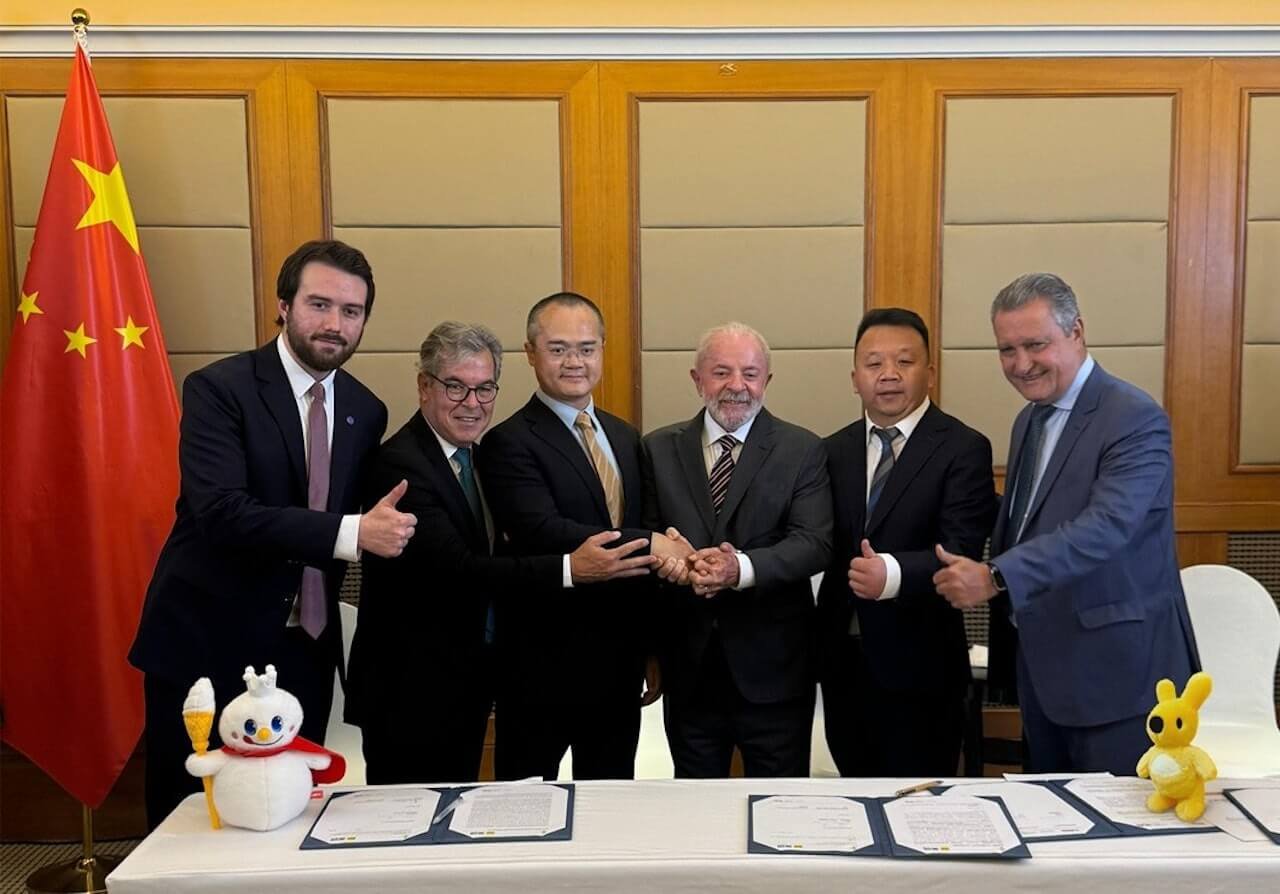

The shared power bank market is experiencing unprecedented growth, as demonstrated by Brick Technology AB’s second strategic acquisition in six months—the purchase of Pluggo. This emerging industry represents a significant opportunity for investors and entrepreneurs looking to capitalize on the expanding mobile charging sector.

Beyond Low Battery Anxiety: Meeting Critical Mobile Needs

The global shift toward hyper-connectivity has transformed mobile charging from convenience to necessity. Shared power bank networks now serve two primary market segments:

Festival and Event Charging: Major events like Tomorrowland create massive demand for portable charging solutions. Attendees rely on mobile devices for:

- Cashless payments

- Social media sharing

- Navigation and communication

- Digital ticketing

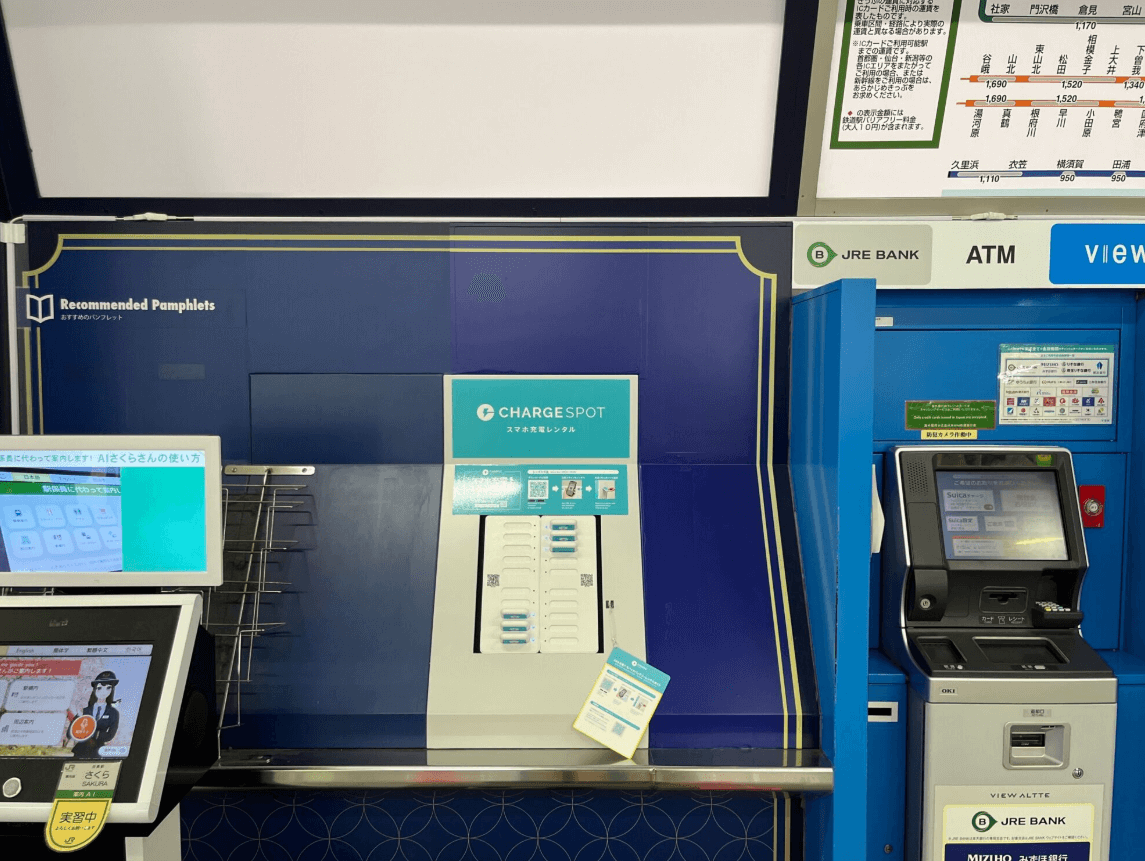

Urban Mobility Solutions: Modern city dwellers require reliable charging access across:

- Transit hubs and airports

- Cafes and restaurants

- Shopping centers

- Business districts

By combining festival expertise with urban infrastructure, companies like Brick create comprehensive charging ecosystems that build customer loyalty across multiple touchpoints.

Strategic Growth Through Market Consolidation

How Acquisitions Drive Rapid Expansion

Brick Technology’s acquisition strategy demonstrates three key growth approaches:

Geographic Market Entry: The Pluggo acquisition provides immediate access to Benelux markets, bypassing traditional market-entry barriers and establishing instant brand presence.

Franchising and Technology Licensing: With 30% annual growth in franchising, Brick proves the scalability of shared power bank business models. Technology licensing allows rapid expansion without significant capital investment.

Operational Synergies: Integrating festival charging services with urban networks creates cross-selling opportunities and improves operational efficiency across the combined business.

Emerging Market Potential

The power bank sharing industry offers multiple investment avenues:

Untapped Geographic Markets: Brick’s CEO indicates plans for additional acquisitions in new regions, suggesting significant expansion potential in underserved markets.

B2B Partnership Development: Strategic partnerships with airports, hotels, co-working spaces, and retail chains offer embedded charging solution opportunities.

Technology Innovation: Advances in battery technology, IoT integration, and faster charging capabilities continue to enhance user experience and operational efficiency.

Revenue Streams and Scalability

The industry benefits from multiple revenue sources:

- Per-use rental fees

- Corporate partnership agreements

- Advertising display opportunities

- Data analytics services

Scalability Factors:

- Low marginal cost per additional station

- Franchise model reduces capital requirements

- Technology licensing creates recurring revenue

- Network effects increase user retention

Market Outlook: Future of Mobile Charging Solutions

Industry Growth Projections

Market analysts predict continued expansion driven by:

- Increasing smartphone dependency

- 5G network rollout increasing power consumption

- Growth in mobile payments and digital services

- Expansion of sharing economy business models

Success Factors for Market Leaders

Companies positioning for long-term success focus on:

- Ubiquity: Wide network coverage across high-traffic locations

- Convenience: Seamless user experience and app integration

- Scalability: Efficient franchise and licensing models

- Innovation: Continuous technology improvements

Key Takeaways for Investors and Entrepreneurs

Brick Technology’s strategic approach—combining targeted acquisitions, franchise expansion, and ecosystem integration—provides a proven blueprint for shared economy success.

The shared power bank market represents more than just solving “low battery anxiety.” It’s becoming essential infrastructure supporting our increasingly mobile-dependent lifestyle.

As mobile device usage continues growing and battery technology struggles to keep pace with power demands, companies that prioritize strategic expansion, operational efficiency, and customer experience will capture the largest share of this electrifying market opportunity.

Bottom Line: The shared power bank industry offers significant growth potential for investors and operators who understand the importance of strategic positioning, scalable business models, and comprehensive market coverage in the evolving mobile charging landscape.