China’s shared power bank industry faces a critical turning point as market leader Monster Energy announces plans to delist amid plunging revenues and consumer backlash against rising rental fees.

Market Leader’s Dramatic Fall

According to a January 5, 2024 announcement, Monster Energy received a privatization offer from Xinchan Capital and its management team at $1.25 per American Depositary Share—representing a 74.8% premium over its recent closing price.

The news triggered a brief 38.46% stock surge on January 8, but the closing price of $0.99 still fell short of the privatization target, highlighting investor skepticism. Since its April 2021 Nasdaq debut, Monster Energy’s stock has plummeted over 90%, erasing more than $2.3 billion in market value. The company’s market capitalization has shrunk to a mere $254 million.

From Late Entrant to Industry Leader

Founded in 2017, Monster Energy was the last to enter China’s “Big Four” power bank providers but quickly dominated the market. By 2020, the company had secured 34.4% market share with over 664,000 merchant locations, 5 million power banks, and 219 million registered users.

However, the company’s financial trajectory has reversed sharply. Revenue figures from 2020 to 2023 show increasing instability (RMB 2.809 billion, 3.585 billion, 2.838 billion, and 2.959 billion), while the first half of 2024 saw revenue collapse to RMB 860 million—a 53.72% year-on-year drop. Net profit similarly plunged 75.01% to RMB 8.829 million.

Price Hikes Alienate Consumers

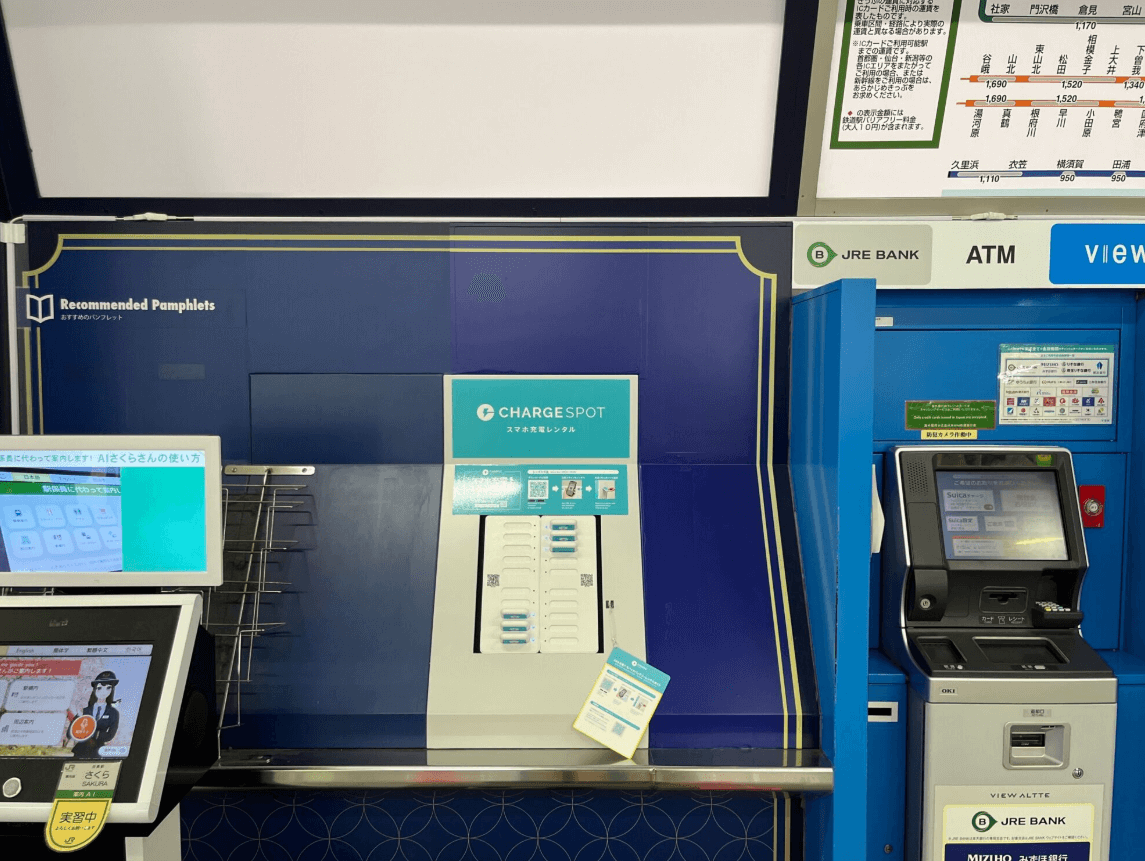

The industry’s aggressive pricing strategy appears central to its current troubles. When shared power banks emerged in 2017, typical rates offered “first 30 minutes free, then RMB 1 per hour, capped at RMB 10 daily.” Today, providers charge RMB 3-6 hourly with daily caps of RMB 30-60.

These price increases have fundamentally undermined the service’s value proposition. Consumers increasingly bring their own chargers rather than pay escalating rental fees, eroding the convenience advantage that fueled the industry’s initial growth.

Monster Energy faces additional challenges beyond pricing. In August 2024, agents from multiple regions filed a lawsuit alleging fraudulent telemarketing practices had caused substantial investment losses.

Industry at a Crossroads

Analysts suggest the shared power bank sector has transitioned from growth to maturity, with current pricing approaching consumer tolerance limits and little room for further profit expansion.

Despite Monster Energy’s pivot toward an agency-franchise model, its privatization move comes amid severely limited options. With depressed stock prices hampering financing opportunities and shareholder value evaporating, the company’s path forward appears uncertain.

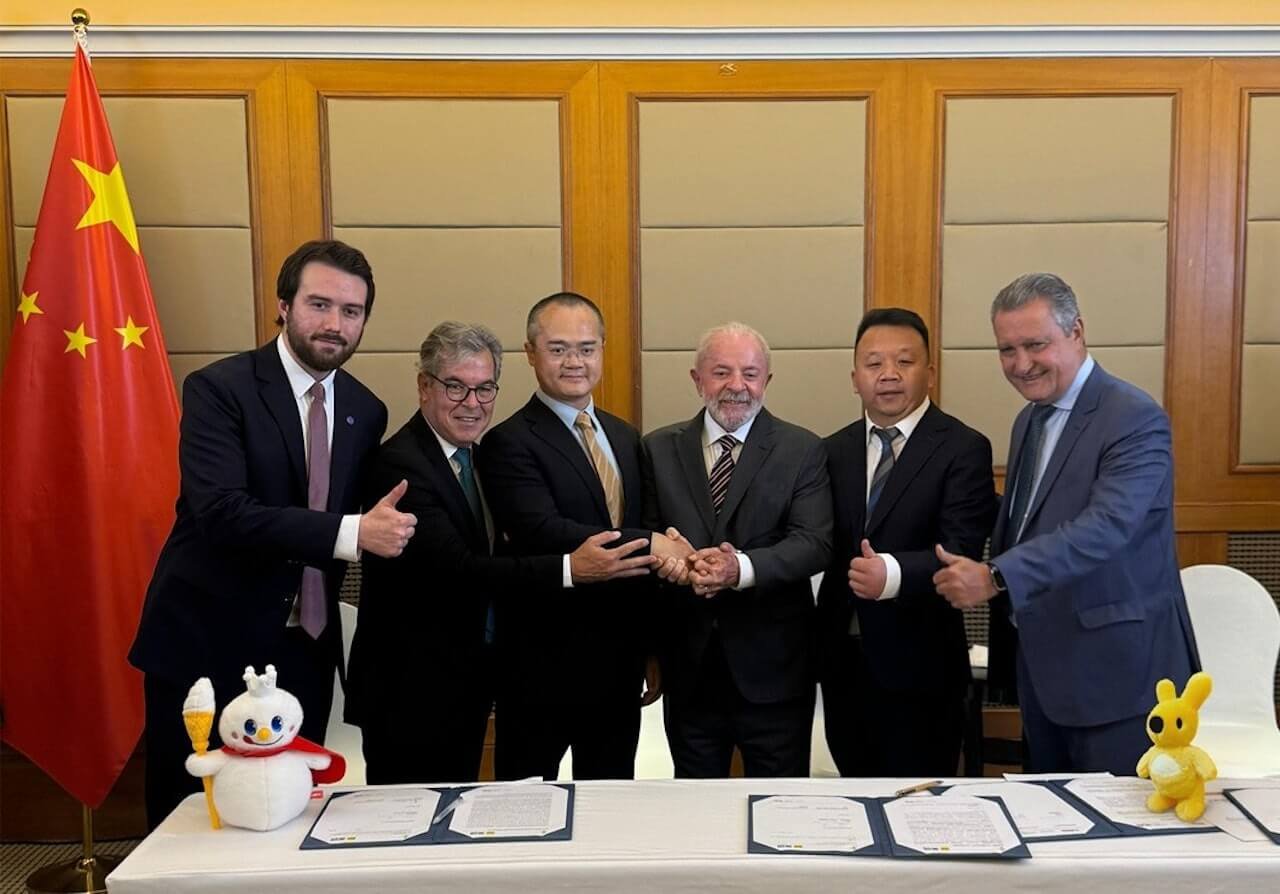

Industry experts believe Monster Energy’s most viable exit may be acquisition by larger consumer companies like Meituan. The broader power bank rental industry now faces an urgent need to reinvent its business model and rebuild consumer trust if it hopes to survive.

The Monster Energy delisting saga represents more than a single company’s failure—it signals potential structural problems in an industry that once epitomized China’s innovative sharing economy but now struggles with sustainability and consumer rejection.