Core News

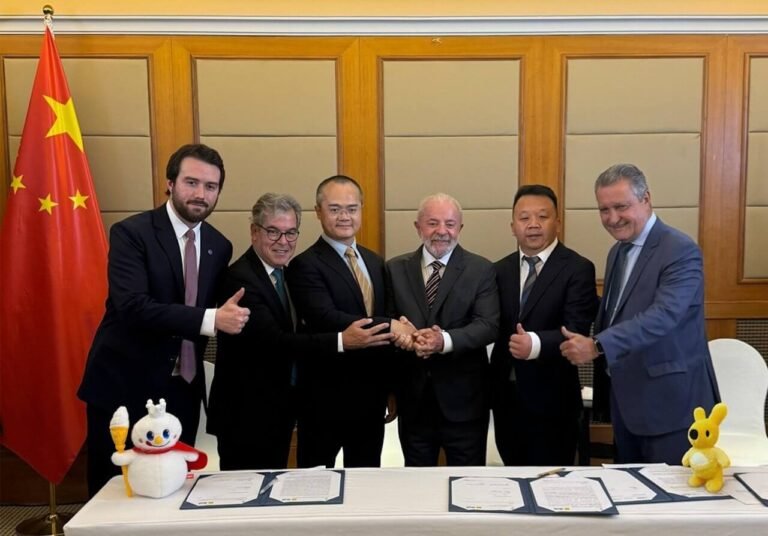

On May 12th, Meituan founder and CEO Wang Xing joined Brazilian President Lula at the “China-Brazil Business Forum” in Beijing, where Meituan announced that its overseas food delivery platform Keeta would officially enter Brazil. The company plans to invest approximately $1 billion over five years to build a nationwide on-demand delivery network.

This marks Meituan’s third major overseas market after Hong Kong and the Middle East. Just one month prior, Didi announced a $176 million investment to restart its Brazilian food delivery service “99Food.” The overseas showdown between China’s two local services giants is set to unfold in South America.

Notably, Brazil’s food delivery market remains relatively primitive—most orders are still placed via phone calls and WhatsApp. Even iFood, the local platform commanding 80% market share, handles only 20% of orders through platform delivery, with the remainder fulfilled by merchants directly. This presents enormous opportunity for Chinese companies to transform the ecosystem.

Trend Insights: The New Logic of Ecosystem Export

Insight 1: From Single Business Expansion to Ecosystem Export

Meituan’s overseas expansion differs from past approaches. Previous Chinese overseas ventures typically involved replicating single products or services, while Meituan is exporting an entire local services ecosystem. Within this ecosystem, food delivery serves merely as a traffic gateway—the real value lies in building a comprehensive service network centered around “immediacy.”

Shared power banks, as high-frequency essential services, naturally align with this immediacy demand. When users await food delivery with dead phones, when riders need charging mid-route, when merchant equipment loses power during business hours—these scenarios all point to the same conclusion: in the mobile internet ecosystem, charging services aren’t add-ons but infrastructure.

Insight 2: Technology Advantage Amplification in Asymmetric Markets

In emerging markets like Brazil, Chinese companies’ technological advantages are significantly amplified. Meituan’s proven capabilities in algorithmic dispatch, intelligent operations, and data analytics—validated domestically—become particularly valuable in markets with relatively underdeveloped infrastructure.

For the shared power bank industry, this technological gap represents enormous opportunity. In domestic markets, companies compete on point-of-sale scale and capital investment; in overseas markets, the competition may center on technological efficiency and operational precision. A charging network capable of remote monitoring, intelligent dispatch, and predictive maintenance holds distinct competitive advantages in both high-labor-cost developed countries and infrastructure-challenged developing nations.

Insight 3: Business Model Reconstruction Opportunity

The domestic shared power bank industry faces a fundamental constraint: business model ceiling. With singular reliance on rental income, user price sensitivity, and diminishing marginal returns from scale expansion, growth prospects appear limited. However, overseas markets, particularly through collaboration with expanding platforms, may spawn entirely new business models.

Imagine shared power banks not as independent rental devices, but as data nodes within Meituan’s ecosystem. Their value extends beyond charging fees to include user behavioral data, geographic intelligence, and consumption pattern analysis. The data value in precision advertising, user profiling, and commercial district analysis far exceeds traditional rental models.

Business Insights: Opportunities and Risks in Hidden Disruption

Opportunity: Synergistic Value Exceeds Independent Value

Meituan’s overseas expansion reveals a crucial trend: in markets with low mobile internet service density, synergistic services far outweigh independent services in value creation.

This suggests future competition may not center on who offers cheaper power banks or more locations, but on who better integrates into local service ecosystems. For companies considering overseas expansion, deep platform integration may prove more effective than independent expansion.

Risk: The Double-Edged Sword of Ecosystem Dependency

Yet this synergy introduces new risks. When companies become overly dependent on single platforms, their fate becomes inextricably linked to platform performance. Meituan’s success or failure in Brazil will directly impact the survival space of its ecosystem partners.

Moreover, different markets present vast variations in user habits, regulatory environments, and competitive landscapes. In Brazil, iFood’s “choose one of two” exclusivity policy forced Didi to exit the food delivery market in 2023, demonstrating how local protectionism poses real threats to foreign enterprises.

Long-term Impact: Global Restructuring of Industry Landscape

From a longer-term perspective, Meituan’s overseas venture may signal the beginning of Chinese local services companies’ globalization. If this experiment succeeds, other giants including Alibaba and JD.com may accelerate their overseas deployments.

For the shared power bank industry, this means fundamental changes in competitive dimensions. Future industry leaders may not be companies with the largest domestic market share, but those first to establish global presence and best adapt to diverse market environments.

Conclusion: A New Game Begins

Meituan’s $1 billion investment represents not just confidence in Brazil’s market potential, but a critical validation of the ecosystem-based overseas expansion model. If successful, this approach will create entirely new development spaces for the entire mobile internet industry chain, including shared power banks.

The real question for the industry isn’t whether to go overseas, but how to go overseas. The era of independent expansion may be ending; the age of ecosystem collaboration is beginning. In this new game, those who first understand and adapt to the new rules will find their place in the globalization wave.