On April 2, 2025, President Donald Trump signed an executive order implementing sweeping new tariffs on imported goods. This policy, set to take effect on April 5, will impose a minimum 10% “baseline tariff” on all imports, with significantly higher rates for countries deemed “worst offenders” in trade practices. This article examines how these new tariffs will affect the shared power bank industry, which has seen tremendous growth in recent years.

Understanding Trump’s New Tariff Policy in 2025

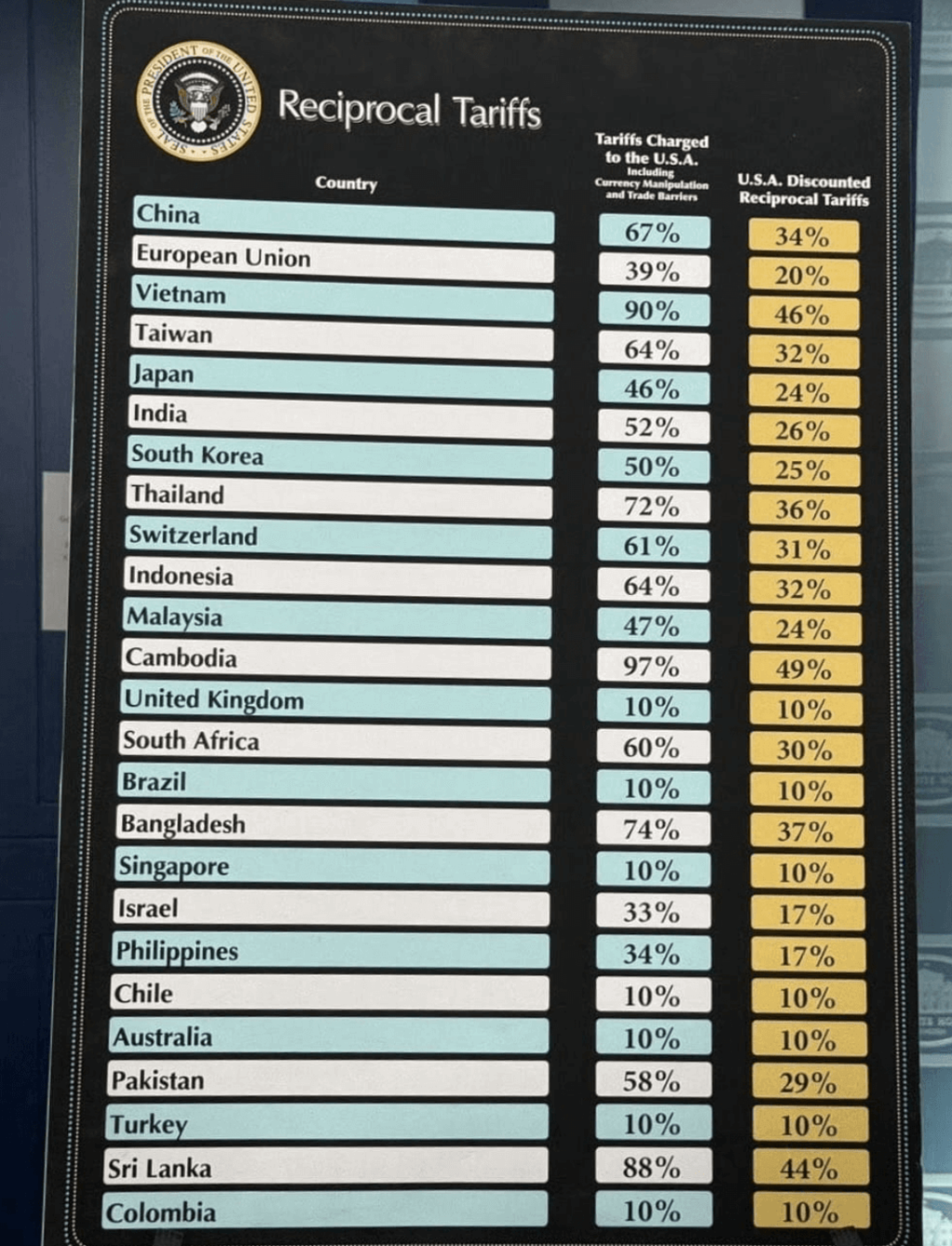

President Trump’s new tariff structure represents what analysts are calling the biggest change to the international trade order since World War II. The policy includes:

- A 10% baseline tariff on all imports starting April 5, 2025

- Higher tariffs on approximately 60 trading partners starting April 9, 2025

- Particularly high rates on Asian manufacturing hubs, including:

- China: 34% new tariffs (totaling 54% when combined with existing tariffs)

- Vietnam: 46%

- Thailand: 36%

- Taiwan: 32%

Trump described the move as a “reciprocal” tariff policy and called the announcement day “Liberation Day,” claiming these measures would make America “rich again.”

Current Market Landscape

Shared power banks have become an essential service for on-the-go consumers worldwide. The industry has seen explosive growth, particularly in:

- Urban centers

- Travel hubs like airports and train stations

- Shopping malls and entertainment venues

- College campuses

China currently dominates the manufacturing of power banks and the components used in them, including lithium-ion batteries, circuit boards, and plastic casings. Many leading shared power bank companies either manufacture their devices in China or source critical components from Chinese suppliers.

Higher Procurement Costs

The most immediate effect of these tariffs will be increased procurement costs for shared power bank companies operating in the US market. With Chinese imports facing a staggering 54% total tariff rate, the cost of importing both complete power bank units and their components will rise significantly.

Companies that have manufacturing facilities in other Asian countries like Vietnam (46% tariff) or Taiwan (32% tariff) will also face substantial cost increases, though not as severe as those relying on Chinese production.

Supply Chain Disruption

Many shared power bank companies have built complex supply chains across multiple Asian countries to optimize costs and manufacturing capabilities. The varying tariff rates will force companies to reconsider their entire supply chain structure:

- Component sourcing may need to shift to countries with lower tariff rates

- Assembly operations might relocate to countries with preferential trade status

- Some companies may consider establishing manufacturing in the US, despite higher labor costs

This restructuring will take time and substantial investment, creating short to medium-term disruptions in product availability and quality consistency.

Business Model Implications

Pricing Strategies

Shared power bank companies typically operate on one of two revenue models:

- Rental model: Users pay based on usage time

- Subscription model: Users pay a monthly fee for unlimited access

Both models will need adjustment to absorb the increased costs from tariffs:

| Business Impact | Rental Model | Subscription Model |

|---|---|---|

| Price Increase | Likely 15-30% higher per-minute rates | Potential 20-40% increase in monthly fees |

| User Response | Higher price sensitivity due to per-use visibility | More gradual adjustment as increases appear only at renewal |

| Market Strategy | May introduce tiered pricing or reduced free minutes | Could add usage caps or create new membership tiers |

Investor Confidence

The shared power bank sector has attracted significant venture capital in recent years. The new tariffs may affect investor sentiment in several ways:

- Reduced profit margins could slow investment in US market expansion

- Startups lacking capital reserves to weather price increases may struggle to secure new funding

- Companies with diversified international operations may redirect investment toward markets with more favorable trade conditions

Adaptation Strategies for the Industry

Localized Manufacturing

One potential long-term response is increased localized manufacturing in the US. This would involve:

- Establishing assembly facilities for final product integration

- Partnering with existing US electronics manufacturers

- Potentially developing component manufacturing capabilities domestically

While this approach would reduce tariff exposure, it requires significant upfront investment and would likely result in higher unit costs due to increased labor expenses.

Product Redesign

Another strategy involves redesigning products to:

- Extend battery life to increase earnings per unit

- Improve durability to extend overall product lifespan

- Incorporate higher-value features to justify price increases

- Use alternative materials or components from countries with lower tariff rates

Market Consolidation

The challenging economic conditions created by these tariffs may trigger market consolidation:

- Smaller operators with limited financial resources may be acquired by larger companies

- Some players may exit the US market entirely

- Partnerships between service providers and venue owners might increase to share costs

Consumer Impact

For American consumers, the effects will likely include:

- Higher rental fees for shared power banks

- Potentially fewer service locations as companies rationalize their networks

- More bundled offerings (e.g., power bank access included with other services)

- Possible service interruptions if supply chain disruptions affect unit availability

Long-term Outlook

Despite the challenges presented by these new tariffs, the fundamental demand for shared power banks remains strong. As smartphones continue to be essential tools with battery limitations, the need for on-the-go charging solutions will persist.

The industry will likely emerge from this period of adjustment with:

- More diversified supply chains

- Some level of domestic US manufacturing

- Higher consumer prices as the new normal

- Fewer but stronger market participants

Conclusão

Trump’s new tariff policy represents a significant challenge for the shared power bank industry, which has relied heavily on Asian manufacturing. Companies in this space will need to quickly adapt their supply chains, pricing models, and market strategies to remain competitive. While some consolidation seems inevitable, the essential nature of the service suggests the industry will ultimately adjust to the new trade reality, albeit with higher costs passed on to consumers.

For industry participants, now is the time to thoroughly assess supply chain vulnerability, explore manufacturing alternatives, and develop pricing strategies that can sustain business operations while minimizing customer loss during this period of adjustment.